Three good ways to handle market volatility

You may be concerned about economic news and market changes. Stock market values and growth indicators have been going up and down.

When things like this happen, it’s important to look at the long-term trends. This can help you make better decisions. And if your goals or financial situation haven’t changed, it’s generally best to stick to your plan.

Sun Life has a long history of helping Clients weather various economic conditions, and we remain committed to providing you with the support you need to achieve your financial goals.

While we can’t control external factors, we can focus on what we can control, like these good practices:

1. Don’t make emotional decisions

Emotional decisions are rarely good ones when it comes to investing. Even if facing a crisis, history proves that you can bank on patience. When you invest regularly, you can take advantage of lower prices on certain investments. And by taking care to not react too quickly, you’re giving yourself the best chance to profit from market recovery.

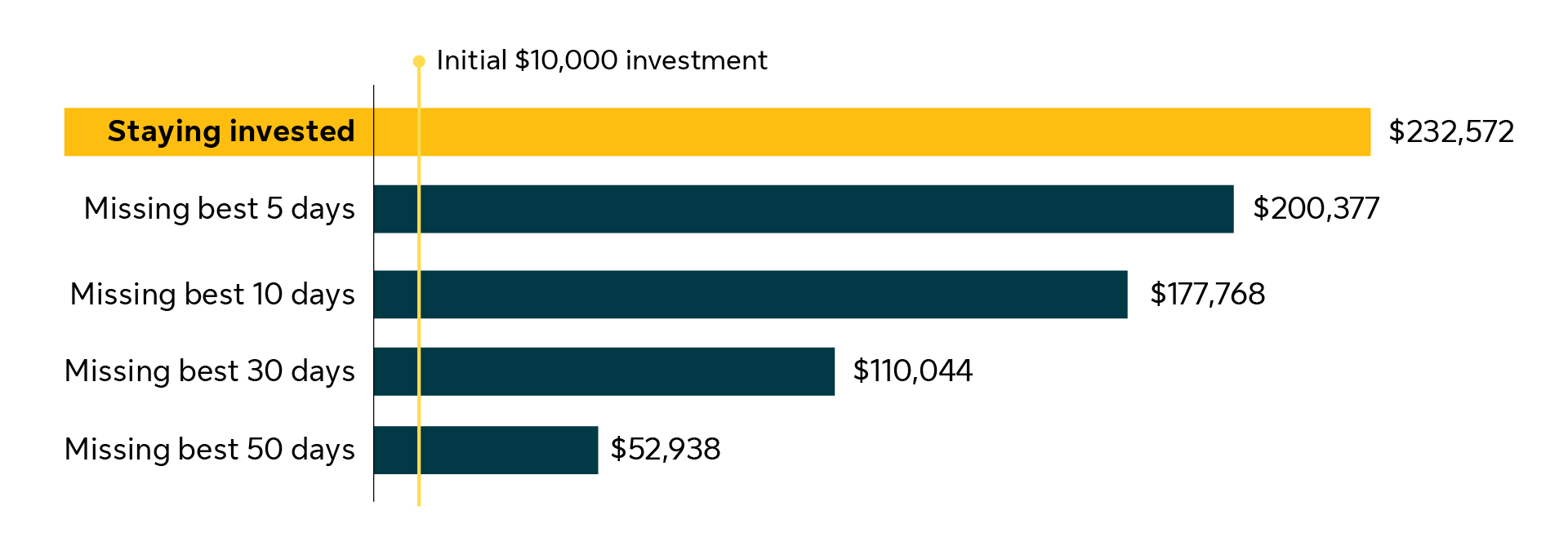

To explain what we mean, consider this graph that shows how missing the best days during a recovery can mean losing out on big gains.

Source: Global stock market returns represented by MSCI World Index. Source: Morningstar. “Best days” is defined as days with the highest growth in percentage terms.

Note: In this example, there was $10,000 invested on January 1, 1985.

2. Look at the big picture

Instead of looking at the daily indicators and worrying – it’s important to look at your entire portfolio’s growth long-term.

It’s a good idea to build your portfolio and diversify it according to your goals and risk profile. It may react differently to market vulnerability. Depending on your personal situation, tolerance for risk, capacity for risk and needs, find the right balance of financial products for you. This can include cash, fixed return, infrastructures, etc.

3. Get personalized advice

It’s what we’re here for! When developing financial roadmaps based on your personal situation, risk tolerance, and goals, we always factor in market swings. That’s why working with an advisor is the best way to navigate the highs and lows of the market.

And of course, if your situation has changed, we’re here to review your plan and adjust if necessary.

If you’d like to connect with a Prospr advisor or if you have any questions, simply:

- Book an appointment using our online tool.

- Call us at 1-888-222-7957, Monday to Friday, 8 a.m. to 8 p.m. ET.

- Email us at Prospr.Advisor.Team@sunlife.com.

This article is meant to provide general information only. Sun Life Assurance Company of Canada does not provide legal, accounting, taxation, or other professional advice. Please seek advice from a qualified professional, including a thorough examination of your specific legal, accounting and tax situation.